The user is the tax collector. Egg in the shells.

Malaysia Free Trade Zones All You Need To Know Tetra Consultants

Services imported by business B2B to be implemented from 1 January 2019.

. B The registration will take effect from 1st March 2019 as provided under section 13 3 of the Service Tax Act 2018. More 65. Service Tax Policy No 12019.

Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018. Whereas for renewal order that unable to. The challenge for a business would be assessing the nature of the services it imports and determining whether they are.

2rd Taxable Period 1 December 2018 -31 January 2019 Two months ODD FYE Month First Taxable Period 1 month. Non-tax Revenues and grants. B EVEN FYE Months 1st First Taxable.

Effective 1 January 2019 any person importing a taxable service into Malaysia for the purposes of business is required to file a return and pay the service tax in respect of the service imported. Customs Duties Goods under the MalaysiaJapan Economic Partnership Agreement Order 2006. Personsmanufacturers are exempted from paying sales tax on import and purchasing locally manufactured goods.

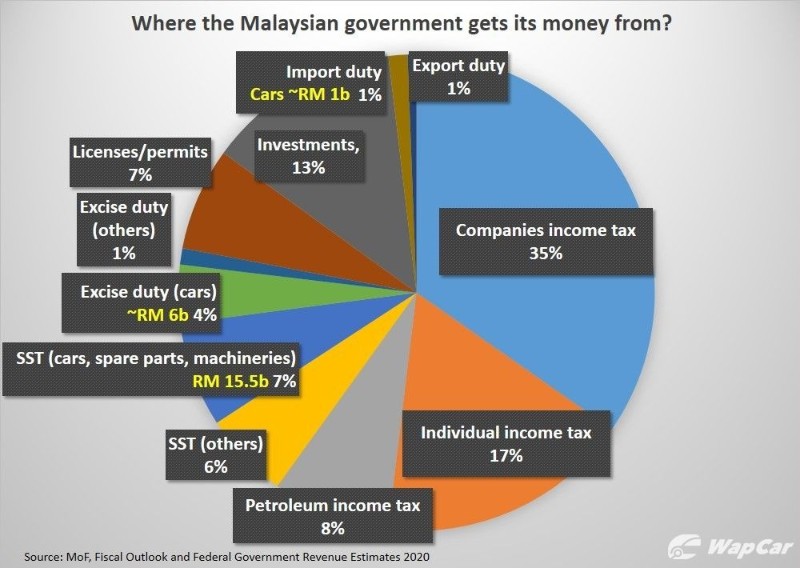

Details of Tax Revenue -. Malaysias tariffs are typically imposed on an ad valorem basis with a simple average applied tariff of 61 percent for industrial goods. Going for Growth 2019.

Budget 2019 Indirect Tax Updates On 2 November 2018 the Malaysia Minister of Finance tabled the 2019 National Budget. More 102. This service tax on ITS at 6 should be accounted for by a Malaysian business when it purchases taxable services from a foreign service provider FSP.

More 101 03092019 Sales Tax Service Tax Orders. Import Duty and Sales Tax Exemption on KN95 Type Face Mask. December 2018 By country.

Malaysia - Import Tariffs Malaysia. Imported Taxable Services. Customs Duties Goods Under the Agreement Establishing the ASEAN - Hong Kong China Free Trade Area Order 2019 Amendment 22020 Customs Duties.

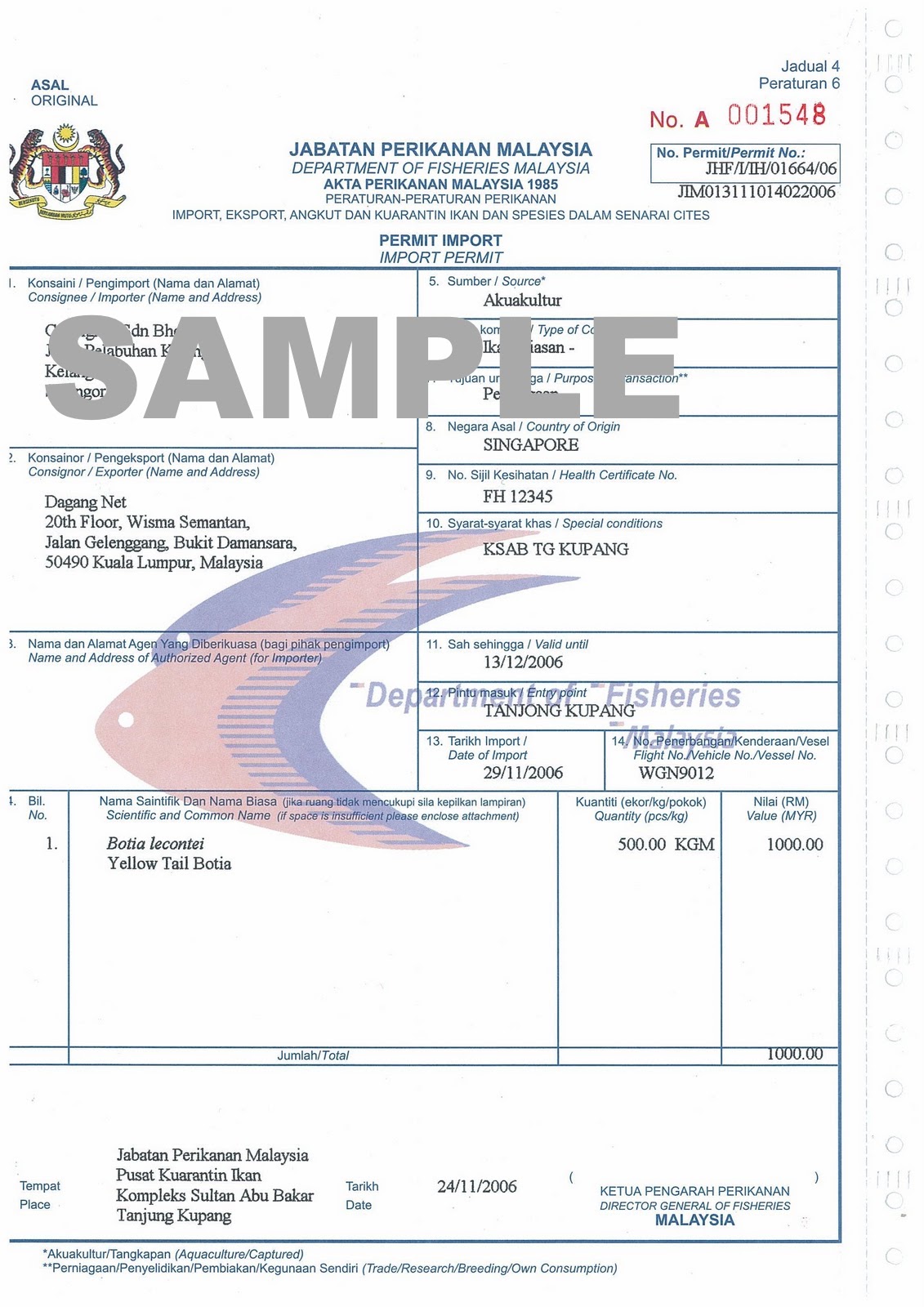

Revenue Statistics - Latin American Countries. Live animals-primates including ape monkey lemur galago potto and others. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2.

B 802019 Published on 19 February 2019. B 6442019 Published on 24 December 2019. Month immediately succeeding the month of January 2019 will exceed the total value of RM500000.

With that E-SPIN Sdn Bhd will have pricing revise on all imported taxable services purchased from overseas vendors effective 1 st of March 2019 for Malaysia government regulatory compliance. Going for Growth Cut-off date. Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles.

The statistic depicts the import duties for motor vehicles from non-ASEAN countries as share of the vehicle value in Malaysia in 2019 sorted by building type. VAT and Customs duties - European Union. Merchandise trade and tariff data for Malaysia MYS Textiles and Clothing import from all countries trading partner including Trade Value Product Share MFN and Effectively applied tariffs count of duty free and dutiable products for 2019.

The Goods and Service Tax GST has been repealed and the old Sales and Service Taxation SST with possible modification will commence in 2018. Were also unclear if the import taxes and duties have been updated since 2006 but assuming MITIs website is kept up to date these should be the rates. All quotation quoted earlier will no longer valid if there is no confirmation of PO received by 28 Feb 2019.

Export Procedures on The Import DutyTax Exempted Raw Materials and Packaging Materials. In 2019 the import duty for CKD. A new provision will be introduced in the Service Tax Act 2018 to enable the recipients of the imported services to account declare and pay the service tax to Malaysia Customs.

Any meat bones hide skin hoofs horns offal or any part of the animals and Poultry. This means that the user should collect the tax from himself and pay it over to the Customs ie. B 4972019 Published on 16 October 2019.

C The registered person shall start charging service tax from 1st March 2019. Being a service tax. The importations of goods specified below are prohibited except under an import licence or permit from relevant authorities.

The imposition of service tax on imported services will be carried out in two phases.

Latest News Chartered Accountant Latest News Accounting

Malaysia Import Of Goods 2020 Statista

Sugar Import In Malaysia Process Of Applying For This License

4 Dec 2018 Investing Activities Financial

Shipping To Malaysia Services Costs And Customs

Import And Export Procedures In Malaysia Best Practices Ansarcomp M Sdn Bhd

Malaysia Market Profile Hktdc Research

How To Import To Malaysia Step By Step Process

![]()

Here S What 2019 Imported Cars Cost Before Taxes In Malaysia

Customs Clearance In Malaysia Duties Taxes Exemption

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Looking To Purchase Vehicles Parts Online From Overseas Stores Watch Out For Import Duties Taxes Paultan Org

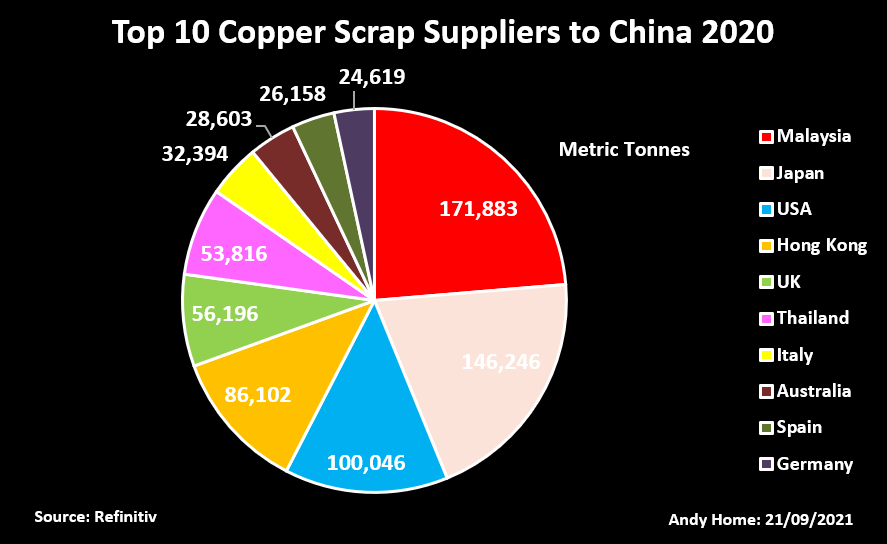

Column Malaysia Deals Fresh Blow To Global Copper Scrap Trade Andy Home Reuters

Canada Imports From Malaysia 2022 Data 2023 Forecast 1989 2021 Historical

Malaysia Imports And Exports World Chocolate Other Food Preparations Containing Cocoa Value

Malaysia Resources And Power Britannica